Weekly Market Recap:

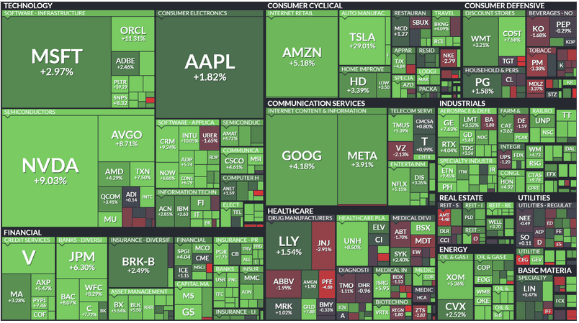

This week, U.S. equities rose sharply, with the Dow gaining +4.61%, the S&P 500 rising +4.66%, the Nasdaq adding +5.74%, and the Russell 2000 outperforming with an +8.57% increase. The rally marked a standout performance across major indices, driven by strong gains in big tech. Notable movers included Tesla (+29%) following the Trump election victory and NVIDIA (+9.1%) after its addition to the DJIA. Key outperforming sectors included GSEs, banks, investment banks, credit cards, and semiconductors, while dollar stores, China tech, and athletic apparel lagged behind.

Treasuries were relatively stable with a slight flattening in the curve; the policy-sensitive 2Y yield edged up to 4.25%, while long-end yields saw a rally. The dollar index was up +0.6%, marking its sixth consecutive week of strength. Gold declined, down 2%, while Bitcoin futures surged +10.7%. Crude oil rose modestly, up +1.3%.

Corporate Highlights:

ASML (-14.0%) reported weak bookings in non-AI segments, raising demand concerns.

TSM (+5.2%) gained on strong earnings and AI-driven margin growth.

Netflix (+5.7%) beat expectations with strong subscriber growth and guidance.

Morgan Stanley (+9.6%) saw strong results in investment banking and wealth management.

UnitedHealth (+4.8%) beat earnings, though medical costs impacted the outlook.

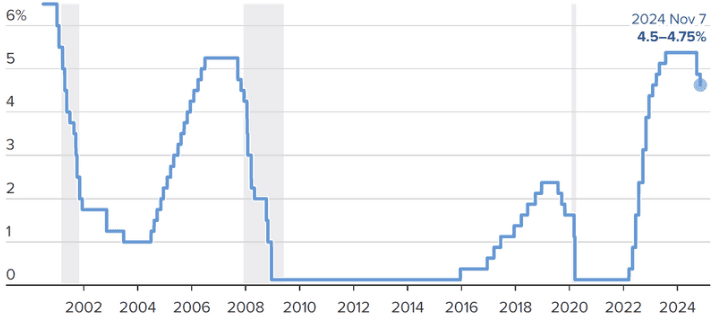

The Federal Reserve’s recent decision to cut interest rates by a quarter point marks a continued, cautious approach to stimulating the economy while balancing inflation concerns. By lowering the benchmark rate to a range of 4.50% to 4.75%, the Fed aims to support employment and prevent economic overheating. This move, the second consecutive cut, reflects a strategic shift away from aggressive inflation control toward a more balanced approach that also addresses labor market dynamics. Fed Chair Jerome Powell described this as a "recalibration" of policy, indicating that the central bank now views economic growth and employment support as equally critical priorities. The unanimous vote reflects confidence among Fed officials that gradual easing is the best path forward, given mixed economic signals. With inflation hovering near the Fed's 2% target and recent softening in employment numbers, the Fed’s actions signal a hope for a "soft landing"—curbing inflation without triggering a recession. However, the economic outlook remains uncertain. Treasury yields have surged despite rate cuts, raising borrowing costs for consumers. In the political backdrop, President-elect Trump’s potential economic policies could introduce volatility, making it harder to predict the Fed’s next steps. For now, markets expect a possible further rate cut in December, but the Fed seems likely to pause in early 2025 to assess the broader impact of its policy adjustments.

Next Week:

Notable Earnings:

Monday (11/11)

Aramark ($ARMK)

Angi Inc. ($ANGI)

Tuesday (11/12)

Tyson Foods Inc. Cl A ($TSN)

Spotify Technology S.A.($SPOT)

Home Depot Inc. ($HD)

Wednesday (11/13)

Experian PLC ADR ($EXPCY)

Dole PLC ($DOLE)

Thursday (11/14)

Advance Auto Parts Inc. ($AAP)

Walt Disney Co. ($DIS)

Friday (11/15)

Alibaba Group Holding Ltd. ADR ($BABA)

Trip.com Group Ltd. ADR ($TCOM)

Notable Ex-Dividend Dates:

Monday (11/11)

Blue Owl Capital ($OWL) 3.22%

Capital Clean Energy Carriers ($CCEC) 3.20%

Tuesday (11/12)

Visa ($V) 0.81%

International Business Machines ($IBM) 3.20%

Wednesday (11/13)

Entergy ($ETR) 3.52%

Thursday (11/14)

Capital One Financial ($COF) 1.46%

Exxon Mobil ($XOM) 3.44% *

Friday (11/15)

Eli Lilly and Company ($LLY) 0.58%

Cintas ($CTAS) 0.74 *

*Dividend Aristocrat