Weekly Market Recap:

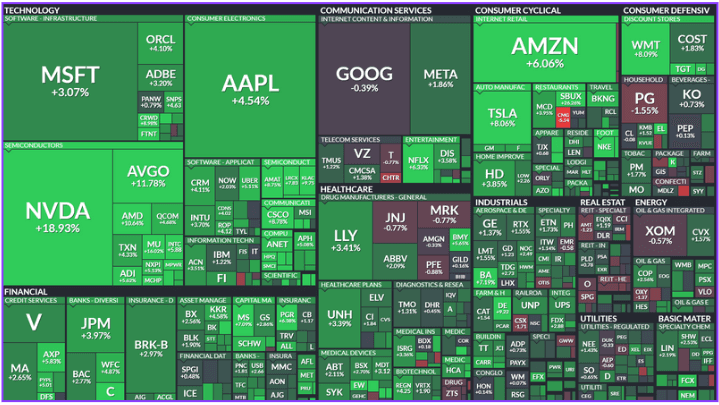

U.S. equities closed higher, with the Dow up 0.24%, S&P 500 up 0.20%, and Nasdaq gaining 0.21%. The S&P 500 and Nasdaq extended their winning streak to seven sessions, driven by positive retail sales and inflation data. Key sectors like banks and tech outperformed, while energy and airlines lagged.

Gold hit a new all-time high, up 1.8%, and Bitcoin jumped 4.9%, but WTI crude fell 1.9%, its fifth decline in six weeks.

Notable Gainers:

B. Riley Financial (RILY) +16.1%

Rocket Lab USA (RKLB) +12.5%

H&R Block (HRB) +12.1%

Notable Decliners:

Silicon Motion (SIMO) -4.2%

Applied Materials (AMAT) -1.9%

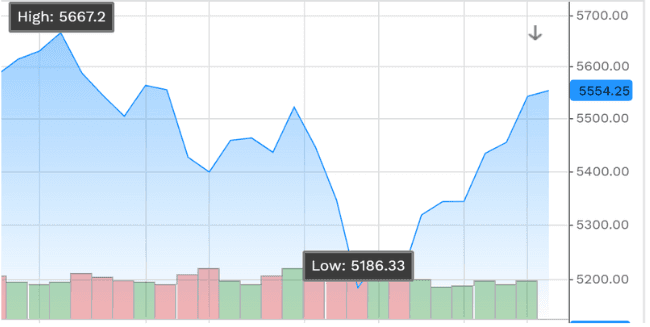

Volatility rocked the equity market last week, raising concerns over the likelihood of a recession and sending investors into a tailspin. As suddenly as the decline, by the end of the day on Friday last week, the S&P 500 had almost recouped its losses to end just 0.05% in the red. The quick rebound was seen as a reassessment on the part of traders that fears of an impending recession and impact from selling off in Japan were misplaced. As Callie Cox from Ritholtz Wealth Management pointed out, 'When we panic, we lower our expectations so far that any news short of disaster feels like rain in the desert.' That explains why markets turned so quickly: because investors saw the drop not as a signal of worse things to come, but as a chance to buy at knock-down prices. History says that market downturns are often too short in time span, and the S&P 500 has bounced back from similar episodes time and again. This recent bounce back serves to reinforce that while fear may drive markets lower, it often is precisely what sets up those opportunities that propel them into recovery.

Next Week:

Notable Earnings:

Monday (8/19)

Palo Alto Networks Inc. (PANW)

3D Systems Corp. (DDD)

Tuesday (8/20)

Lowe's Cos. (LOW)

Workhorse Group Inc. (WKHS)

Wednesday (8/21)

Target Corp. (TGT)

Macy's Inc. (M)

Thursday (8/22)

BJ's Wholesale Club (BJ)

Peloton Interactive Inc. (PTON)

Friday (8/23)

Buckle Inc. (BKE)

Notable Ex-Dividend Dates:

Monday (8/19)

Chevron (CVX) - 4.39%

United Parcel Service (UPS) - 5.29%

Tuesday (8/20)

Prudential Financial (PRU) - 4.86%

Phillips 66 (PSX) - 3.43%

Wednesday (8/21)

Aflac (AFL) - 2.10%

Target Corp. (TGT) - 3.06%

Thursday (8/22)

Energizer (ENR) - 3.82%

Discover Financial Services (DFS) - 1.98%

Friday (8/23)

Bath & Body Works (BBWI) - 2.54%

Hilton Worldwide (HLT) - 0.29%

*Dividend Aristocrat